OPEC+ Likely To Extend Production Cuts In June

By John Kemp, senior energy analyst at Reuters

Saudi Arabia and its allies in OPEC⁺ are likely to keep oil production unchanged for a further three months when ministers review output allocations on June 1.

The tightening of petroleum supplies and depletion of inventories widely anticipated at the start of the year has failed to materialise so far. If OPEC+ officials had hoped to increase production into a tightening market characterised by rising oil prices they are likely to be frustrated.

Crude stocks, futures prices and calendar spreads are all at similar levels to a year ago, making a significant increase in output unlikely.

The group may nonetheless decide it needs to rescind some of last year’s output cuts to pre-empt a further rise in production from the United States, Canada, Brazil and Guyana and avoid conceding more market share.

But current market conditions mean any increase is likely to be symbolic, in the absence of a wholesale shift in strategy to increase volumes and accept lower prices.

PRICES AND SPREADS

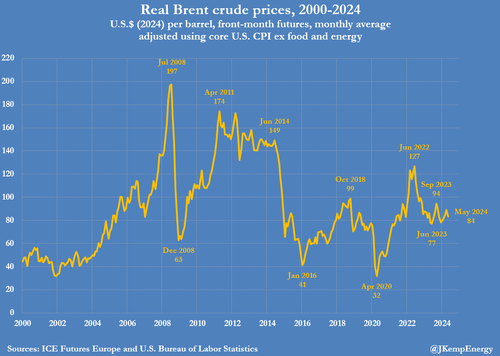

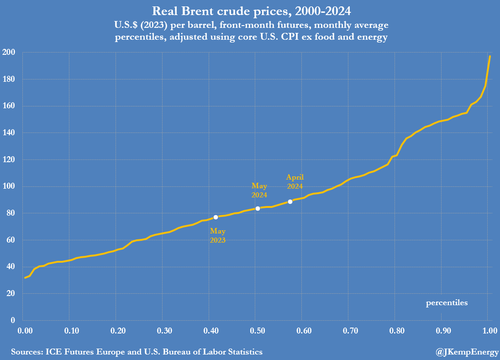

Front-month Brent futures have averaged $84 per barrel so far in May putting them exactly in line with the average since the start of the century after adjusting for inflation.

Prices have risen by just $6 per barrel (7%) compared with a year ago when the group was planning production cuts to boost them.

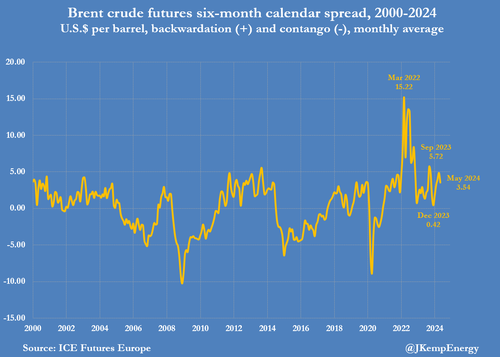

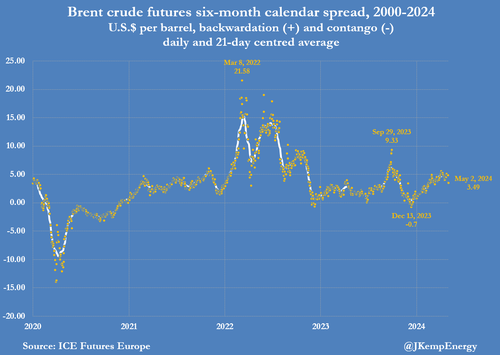

Brent’s six-month calendar spread has traded in an average backwardation of $3.54 (86th percentile for all months since 2000) so far in May compared with $1.81 (60th percentile) this month in 2023.

The increased backwardation implies traders see the market somewhat tighter than in 2023 with a greater likelihood inventories will deplete over the rest of 2024. But the backwardation has been breaking down in recent weeks and has already narrowed from an average of $4.86 (95th percentile) in April.

Despite an increase in tensions across the Middle East, causing a temporary rise in the war risk price premium, there has been no actual impact on oil supplies, and the premium has largely faded.

Diplomatic efforts have contained conflict between Iran and Israel, with no impact on either oil production or tanker exports from the Persian Gulf.

Tanker traffic has been re-routed from the Red Sea and the Gulf of Aden around the Cape of Good Hope to avoid drone and missile attacks from Houthi fighters based in Yemen.

U.S. OIL INVENTORIES

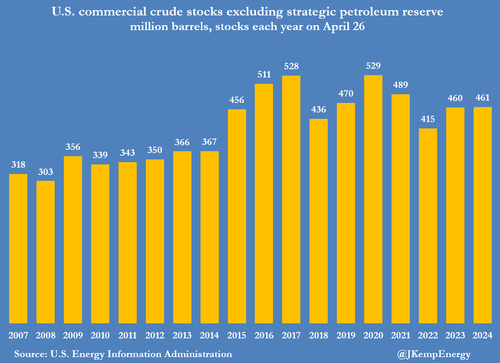

In the United States, commercial crude inventories are at almost the same level as this time last year and close to the prior ten-year seasonal average. Commercial crude stocks amounted to 461 million barrels on April 26 compared with 460 million barrels a year earlier.

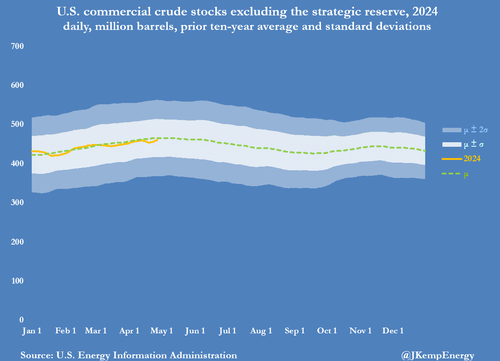

Crude inventories were just 5 million barrels (-1% or -0.11 standard deviations) below the prior ten-year seasonal average.

There have been no signs of a significant and sustained draw down of inventories that would indicate the market has been under-supplied.

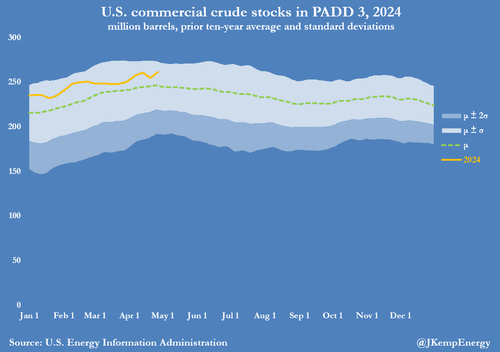

Most U.S. crude inventories are held at coastal refineries and tank farms along the Gulf of Mexico, which is also the region most closely integrated with the global sea-borne market.

Gulf of Mexico stocks amounted to 262 million barrels on April 26, which was 6 million barrels above the same time last year…

…and 15 million barrels (+6% or +0.57 standard deviations) above the ten-year seasonal average.

The United States is not the whole global market but given the efficiency with which traders move barrels to exploit local discrepancies between production and consumption, it is a good marker for the global balance.

U.S. crude inventories, global futures prices and to some extent softening calendar spreads all point to a market fairly close to balance. Portfolio investors certainly seem to think so, with roughly equal upside and downside risks to prices.

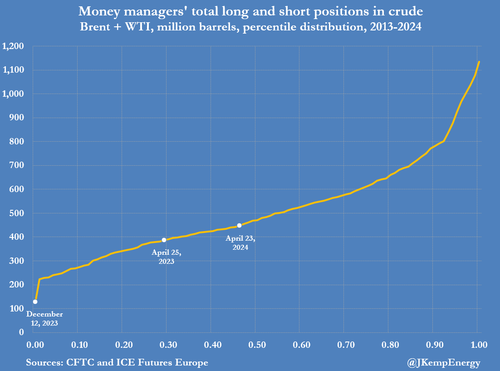

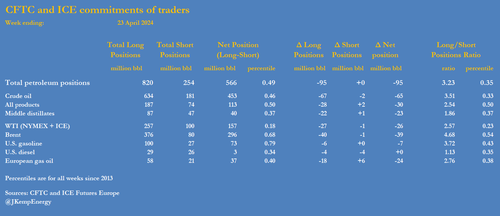

On April 23, hedge funds and other money managers held a net long position in futures and options linked to crude prices equivalent to 453 million barrels (46th percentile for all weeks since 2013).

The position was an increase from 388 million barrels (29th percentile) at the same point in 2023 but was basically neutral.

Neither fund managers nor physical traders are signalling the need for an increase in production from Saudi Arabia and its OPEC⁺ allies in the third quarter.

PRODUCTION POLICY

Senior OPEC ministers and officials stress the group’s policy is to be proactive and forward-looking. That may be true when it comes to reducing production to avert an increase in excess inventories and stabilise prices.

When it comes to increasing production, however, the group has normally waited until stocks have fallen and prices have already risen significantly.

In this instance, inventories and prices close to the long-term average imply ministers are likely to decide to keep output unchanged, based on their behaviour in the past. In the last decade, OPEC⁺ production cuts have propped up prices and supported continued growth in output from outside the group especially in the western hemisphere.

Some members of the organisation have expressed concerns about the loss of market share and pushed to increase production.

So far, Saudi Arabia has led OPEC⁺ in cutting production to reduce stocks and boost prices at the expense of volumes.

There are questions about the long-term sustainability of this strategy, but so far there’s no sign of a fundamental rethink.

If ministers eventually decide the loss of market share has gone too far, they could cite stronger forecast demand and a predicted future decline in inventories to justify boosting production.

That would reveal a major change in strategy to prioritise volume over prices and there is no sign of it yet. If OPEC⁺ nonetheless decides to announce an output increase, it is likely to be small and symbolic.

Tyler Durden Mon, 05/06/2024 – 05:00

Source: https://freedombunker.com/2024/05/06/opec-likely-to-extend-production-cuts-in-june/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.