Finding The Next Apple Using Buffett’s Logic

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

On the heels of Apple’s latest earnings report, the Wall Street Journal shared an article discussing how Apple became such an oversized investment of Warren Buffett’s company, Berkshire Hathaway. Given their success with Apple shares we think it is worth understanding the logic that drove Buffett to accumulate such a large position in Apple.

Unbeknownst to most, Todd Combs, a member of the Berkshire portfolio management team, is responsible for bringing Apple to Buffett’s attention. However, not all credit goes to Combs. Buffett presented Combs with a challenge that ultimately highlighted Apple’s value proposition. With this same challenge, we will take a stab at finding the next Apple.

The inspiration for our challenge and a few quotes in this article come from a Wall Street Journal article entitled Apple is Buffett’s Best Investment.

Berkshires Massive Stake Of Apple

Before finding the next Apple stock, it’s worth visualizing how Berkshire’s investment in Apple has grown over time as a percentage of Berkshire Hathaway and of Apple’s total shares outstanding.

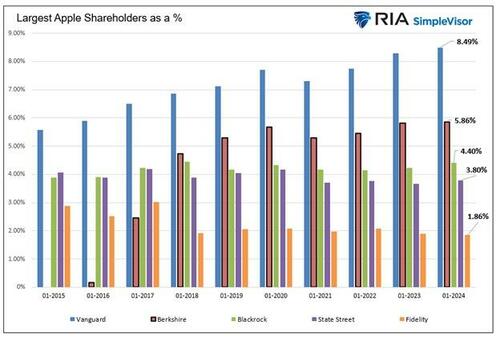

The bar graph below compares Berkshire’s percentage ownership of Apple to that of the four largest mutual fund and ETF complexes. Berkshire had no position in Apple in 2015 and now holds over 5% of the company. Only Vanguard has a more significant position.

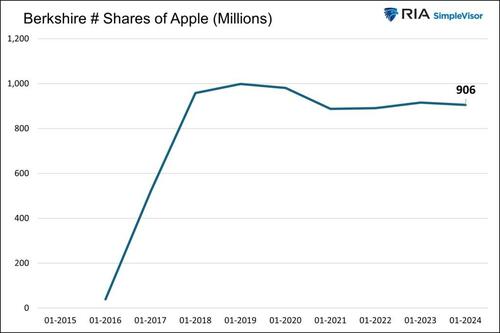

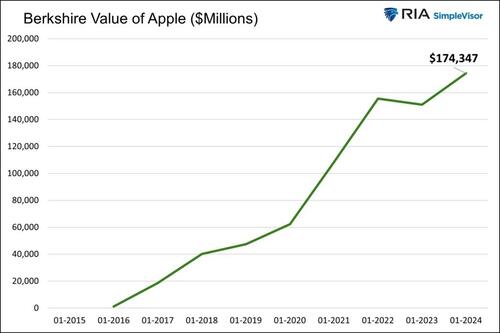

The following graphs plot the surge in the number of shares owned by Berkshire and the value of its shares.

The pie chart below shows that Apple comprises almost half of Berkshire’s portfolio. The next largest holding is Bank of America at 10%.

Buffett Doesn’t Like Tech

Ironically, when Berkshire started buying Apple shares, Warren Buffett had an aversion to technology stocks. When asked why, he said he didn’t invest in companies he didn’t understand. He now admits that was a mistake.

While it may have been a mistake not to buy more technology companies in the mid twenty-teens, Buffett was able to appreciate what Apple truly was. While it is classified as and widely considered a technology company, Buffett got his head around Apple by likening it to a consumer goods company. Per the aforementioned Wall Street Journal article:

Considering the stock, though, Buffett began to see it as a consumer-goods company with enviable, latent pricing power, rather than as a tech or an electronic-device maker, according to people who have spoken to him. The loyalty consumers had for Apple products, especially the iPhone, suggested to Buffett that they would be willing to pay much more for upgraded versions of the phone in the years ahead, a sure way to boost profits.

Todd Combs- The Unknown Mastermind

The Wall Street Journal article introduces Todd Combs, one of Berkshire Hathaway’s lesser-known portfolio managers. According to the article, around 2016, Buffett challenged Combs to find a stock that met specific criteria.

Among the stocks Combs found meeting the fundamental criteria and large enough for Berkshire to purchase was Apple. The rest is history. Since they started accumulating Apple in 2015, it has gained 650%, more than four times the S&P 500 over the same period.

Given Combs’ success, we thought it would be interesting to use the logic Buffett challenged Combs with and produce a similar scan. Let’s see if we can find the next Apple.

Buffett’s Logic

The following paragraph from the WSJ article is the logic Buffett imparted to Combs, leading to their ownership of Apple.

This time, Buffett asked Combs to identify a stock in the S&P 500 that met three criteria.

The first: a reasonably cheap price/earnings multiple of no more than 15, based on the next 12 months’ projected earnings.

The stock also had to be one the managers were at least 90% sure would enjoy higher earnings over the next five years.

And they had to be at least 50% confident that the company’s earnings would grow by at least 7% annually for five years or longer.

What made the search a little more difficult was that the companies that met the criteria also had to have a market cap large enough so Berkshire could buy enough of to move the needle of its portfolio but not overly impact the demand for the stock.

The Combs Scan

In addition to the criteria in Buffett’s challenge, we added sales growth of at least 5% over the last five years. This helps us thin the list of companies to those already exhibiting strong top-line growth. We also removed financial, limited partnerships, REITs, and real estate stocks as their valuations and growth rates are not as easily comparable using traditional valuation metrics. Lastly, we disqualified Chinese companies due to the potential for political implications.

The following are the factors we used to screen for the next Apple.

-

Market cap > $50 billion

-

Price to Forward Earnings <15

-

Five-year expected earnings growth >5%

-

Sales growth in last five years > 5%

-

No financial, limited partnerships, REITs, real estate, or Chinese companies.

Many stocks meet the size, earnings, and sales growth criteria. But only two companies have cheap enough valuations to make the cut as shown below.

Currently, Berkshire has 5.242 million shares of T-Mobile, which is .20% of the portfolio. T-Mobile met our criteria, but its 5-year expected earnings growth is slightly below Buffett’s 7% bogey.

Berkshire does not hold EOG but has other oil and gas exploration companies, including Occidental Petroleum and Chevron.

Summary

Warren Buffett is an investing legend and one of the wealthiest people in the world. He takes a value orientation with a long-term investment horizon.

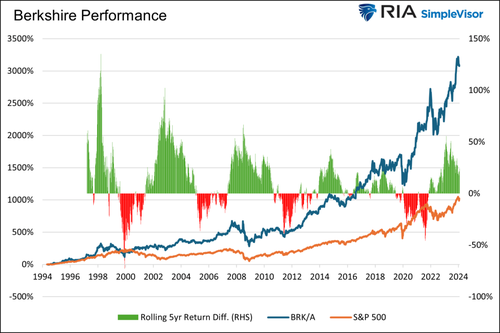

The Berkshire Hathaway portfolio, which also owns private companies, has done exceptionally well versus the market, as shown below. However, he goes through prolonged periods of poor relative performance versus the market.

The graph shows that over the last 30 years, Berkshire’s price return has tripled that of the S&P 500.

However, there are four notable extended periods where he grossly underperformed the market.

Also of note is that Berkshire handily beat the market in the recession and drawdowns of the dot com bubble and financial crisis. Such attests to his value orientation.

Tyler Durden Wed, 05/08/2024 – 14:05

Source: https://freedombunker.com/2024/05/08/finding-the-next-apple-using-buffetts-logic/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).